Digital strategy, key to competing in a customer-centered environment.

Digital strategy, key to competing in a customer-centered environment.

Banking is undoubtedly one of the sectors that has changed the most in recent years. The emergence of a new type of banking client, more informed and demanding personalized attention, poses a series of challenges that can be successfully faced through the development of a digital strategy.

The General Bank of Panama is one of the financial institutions that has understood this reality. Next, Leonidas Anzola, Vice President of Information Technology at Banco General, shares some aspects that must be taken into account when implementing a digital strategy.

What is a digital strategy?

A digital strategy means something different for each organization. It is related to the strengths, opportunities, weaknesses and threats in their environment. However, you should consider the elements available to serve them. The new methods and technologies allow to create capacities and functionalities never seen before, but it is very important to work closely with the client who will use them to achieve the greatest value.

The digital strategy is developed by understanding and analyzing all these available elements: SWOT, client, methods and technologies.

In summary, a digital strategy is those actions that organizations must identify and execute to compete quickly in a more customer-centric environment, who has at their disposal, knows and uses more disruptive technologies. Well defined and executed, it must quickly produce value to the client and the company.

To prepare for these challenges, where to start?

The first step is to see where you want to reach and what capabilities to develop, like any other initiative. He who has not begun on this path can be said to be late. After defining their strategy, some organizations choose to establish agile teams and build a new architecture, others decide to build the architecture first. Regardless, both exchange actions are necessary.

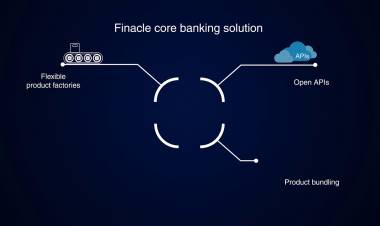

Legacy architectures and their pillars do not facilitate the digital strategy process; however, they are usually your support. Creating an architecture around them is essential to exploit information, which is the most important thing in a company.

Deciding what to do more than ever is based on asking the client, this indicates the path we must follow to add value and grow the company.

What do you think is the role of traditional financial services institutions in a digital world?

The fundamental role is the same as always, to compete. Both evolving our own digital services and developing new capabilities. The important thing is to transform through alliances, disciplines, methods and architectures. Information and clients belong to traditional financial services, not retaining or growing them is in our hands. It is necessary to understand that we must quickly take advantage of changes in the environment: customer behavior, development techniques, philosophies of needs assessment, new technologies, among others. The risk lies in not culturally transforming our companies and continuing to do things in the same way.