How will the digital transformation affect us?

How will the digital transformation affect us?

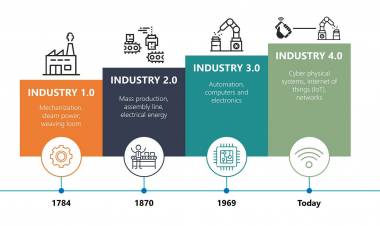

The transformation will be much deeper than knowledge economy is assuming. It will affect people throughout our environment. At home we can connect and control "all things" and cities will be transformed. But it will also affect the vast majority of the active population of developed and emerging countries. The automobile industry has initiated the digital transformation of vehicles, incorporating sensors that offer new digital services related to safety or comfort: Internet connectivity, hands-free voice recognition, direct contact with the workshop in case of breakdown, geolocation in the event of an accident or radars that indicate the proximity of others cars if we get out of the lane Soon electric cars will be accessible Innovations are also unleashed in the way of manufacturing, installing and managing these new products and services not known until now, so we will have to radically change our professional skills.

The challenge of choosing the right innovation model The world of financial services is changing rapidly. Consumers want more personalized services that increase their comfort and maintain their safety. Financial inclusion has been working in the different markets of the region and, definitely, all over the world, but one of the strongest trends has to do with the "inclusion of connectivity", which goes beyond what we know as inclusion financial, because it is produced by the mobile connection (smartphones). Today innovation is a business imperative for banks around the world. In emerging markets, the pace and promise of innovation are even greater.

Banks must do more to keep up, or be left behind. However, many banks are still not innovating as fast as they should to remain competitive, especially with the trend that will reach the region. And, despite developing mobile services and digital banking, traditional banking has an important barrier: the transfer of knowledge and deployment of innovation, because while "they go to 50km / h, other more technological means go to 150km / h" , and, in the long run, the difference will be felt

How will companies change?

The digital transformation through hybridization and the connection of products, things and people implies the possibility of innovation on a scale not previously imagined and applicable to all types of products and services. At the same time, technologies facilitate the way of working in open networks or in creative ecosystems, through open and collaborative innovation processes among company workers, other innovation organizations and the participation of people outside the company.

Fintech (the mix of finance and technology) are start-ups of innovation and technology that are capturing a part of the financial services market globally, making life easier for customers, focusing mainly and in a revolutionary way on payments and transactions, personal finance management, consulting and marketing platforms for investments and new approaches to financing and granting loans.

Traditional banking must rise to the wave of innovation to modernize and modernize processes through mobile channels: a more beneficial way to the consumer. Many banks, insurance companies and others related to financial services are already adopting mechanisms similar to fintech, even developing their own or allying themselves with others.The innovation model must be correct, but always be aware of trends. Something must tell us the global investment of US $ 19 billion in fintech, in already 4,000 of this type of companies. The potential of regional banking is great, but the challenges that come too.

Why do we talk about digital ecosystems?

For the development of new products and services and their delivery to customers, it will be necessary to develop digital ecosystems in which various specialized companies without legal relations will participate, which will organize the production in a decentralized way combining internal resources with commercialized, virtualized and distributed globally, with the objective of retaining customers within the ecosystem.