5 keys to the digital transformation of banks.

5 keys to the digital transformation of banks.

Payment platforms through mobile devices have had significant growth over the past few years. The emergence of systems such as Apple Pay or Microsoft Wallet have generated some discomfort in the banks, however, they are part of the evolution proposed by the financial disruption.

In this exercise of developing new dynamics to adapt to this environment, it is imperative to achieve a splice with the least possible noise. According to a concept issued by VISA, there are 5 key aspects to achieve an effective digital transformation:

-

Entities must reinvent digital issuance: in this measure, banks create their own mobile wallets, which guarantees a more effective flow of money and according to the time.

-

It is necessary to generate a more integrated experience: to achieve this you must offer promotions or rewards for those users who adopt this payment mechanism.

-

Improve the transaction experience: risk must be minimized and the chances of approval increased (not only in plastics). Additionally, transaction alerts or confirmations for mobile devices should grow.

-

The redefinition of cross-selling will be useful for the consumer to be more willing to use mobile benches. Currently, products such as mortgages or loans depend on robust infrastructure.

-

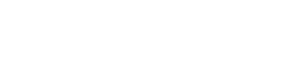

Technology adoption: banks should look for ways in which technology is in their favor. To this extent, investing in developments that allow innovating and automating processes is essential.

It is clear that there is no single methodology to implement a transformation of this level. However, these keys are common denominators in entities that are at the forefront of such change. In this measure, it is important to carry out an a priori analysis that contemplates the best way to implement these keys, their times, costs and impacts.