AI vs money laundering. Who wins?

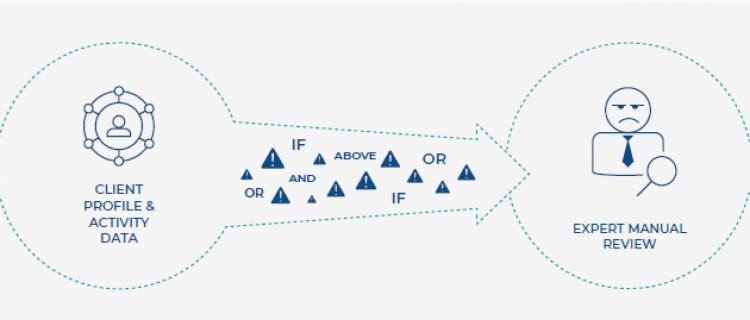

With a million-wide customer base, banks have introduced automated transaction monitoring systems. Traditionally, they are based on a limited number of predefined money laundering detection scenarios, known as rules or conditions. If an account holder violates any of these rules, an alert is generated.

This is very imperfect. Firstly, the rule-based systems are usually based on patterns observed in historical cases. Thus, many banks can only detect money laundering cases that were similar to these observed in the past.

Secondly, most of the existing transaction monitoring systems are producing an unwieldy number of alerts that require to be reviewed manually by AML analysts. Apparently, around 95 percent of alarms raised by current systems are false alarms, as reported by Reuters. However, our experience shows that in some banks even more than 99 percent of alerts are irrelevant. What does it mean in practice? It means that AML analysts spend most of their efforts on alerts that should never have been created.

What can we do about it?

We believe that artificial intelligence (AI) is the future of AML systems. We have proved that machine learning algorithms can be used to boost the effectiveness of the overall AML process. The figure below illustrates the AI-enhanced AML process, where you can see alerts ranked by importance: